airfighters.ru

Market

How To Trade In Derivatives

To start trading derivatives, users need to first deposit eligible collateral assets in their wallet to have a Margin Balance. · In the Wallet Details box, you. Discover LSEG's derivative solutions and learn how our leading financial data, capital markets, and post-trade services can help support your business. A derivative can be traded on an exchange or over the counter. The fluctuations influence the price of derivatives in the underlying asset. Derivatives are. In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index. 1. Risk management: · Advantage: Derivatives act as powerful risk management tools, allowing investors to hedge against price fluctuations and uncertainties. How to Trade in Derivatives: Step-by-step Comprehensive Blueprint Exposing the Secret Strategies Used by Top Traders to Dominate the Derivatives Market and. An option is a contract to buy or sell a specific financial product. Various derivative instruments besides options include swaps, futures, and forward. A derivative exists as a contract between two parties, and its value fluctuates in direct relation to its underlying asset. Derivatives can be traded in two distinct ways. The first is over-the-counter (OTC) derivatives, that see the terms of the contract privately negotiated between. To start trading derivatives, users need to first deposit eligible collateral assets in their wallet to have a Margin Balance. · In the Wallet Details box, you. Discover LSEG's derivative solutions and learn how our leading financial data, capital markets, and post-trade services can help support your business. A derivative can be traded on an exchange or over the counter. The fluctuations influence the price of derivatives in the underlying asset. Derivatives are. In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index. 1. Risk management: · Advantage: Derivatives act as powerful risk management tools, allowing investors to hedge against price fluctuations and uncertainties. How to Trade in Derivatives: Step-by-step Comprehensive Blueprint Exposing the Secret Strategies Used by Top Traders to Dominate the Derivatives Market and. An option is a contract to buy or sell a specific financial product. Various derivative instruments besides options include swaps, futures, and forward. A derivative exists as a contract between two parties, and its value fluctuates in direct relation to its underlying asset. Derivatives can be traded in two distinct ways. The first is over-the-counter (OTC) derivatives, that see the terms of the contract privately negotiated between.

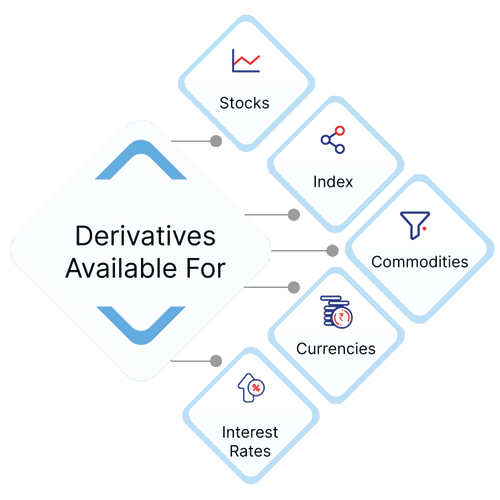

To access Small Exchange futures, you will need a futures trading account, a process similar to that of accessing options and stocks. Choose a broker that fits. What is futures trading? 1m 8s. Access live virtual classes on this topic: Introduction to Commodity Derivatives. ×. ✓ Watched. Now Playing. 0. Why Trade. Types of Derivatives · Derivative contracts with the right to buy or sell an underlying asset. These are mostly known as rights contracts. · Derivative contracts. Derivative trading involves both buying and selling of these financial contracts in the market. With derivatives, you can make profits by predicting the future. Trading with leverage on derivatives involves entering into a buy or sell position and speculating on which way their chosen market will move, using a. Derivatives as financial instruments depend upon underlying assets for their value. In other words, Derivatives trading is the purchase or sale. A consistent model that defines all lifecycle events and processes for traded products can position firms to achieve simplification and scale in post-trade. So what's an example of a derivative market? StoneX offers derivative trading on several markets, including: Spot trading – securities traded for immediate. Currency derivatives: Exchange-traded derivatives markets list a common currency pairs for trading. Futures contracts or options are available for the pairs. FlexTrade's Automation and Analysis tools empower traders with advanced trade routing, market impact insights, execution cost tracking, and post-trade analysis. Derivatives are instruments used by traders to adjust for price risk in the market of the underlying assets eg derivatives in the stock market. Learn what are derivatives & how to trade in the derivatives market, the 4 types of derivatives products and how derivatives can fit into a portfolio for a. We offer a comprehensive range of derivative products and services covering equity, index, interest rate and commodity derivatives. derivatives? The easiest way to start trading derivatives is via an online regulated broker such as FP Markets: Open a Live Account or learn to trade using a. Derivatives Trading Basics By proceeding, you agree to the T&C. Derivatives trading occurs through futures or options contracts between two parties at stock. By short selling Futures contracts. How to start trading? Similar to the Equity Market, any trader of derivatives will have to open an account. Financial Derivatives trading Derivative contracts are commonly used by the majority of the world's largest companies, so they can better manage their risk. Low transaction costs – Derivative contracts play a part in reducing market transaction costs since they work as risk management tools. Thus, the cost of. 2 A small group of large financial institutions continues to dominate trading and derivatives activity in the U.S. commercial banking system. During the first. Future and option contracts are among the key instruments of derivatives trading. Derivatives, for the beginner, are contracts the value of which depends on.

Coinbase Add Money

Sign in to Coinbase and navigate to Payment methods. · Select Add a payment method. · Select your preferred payment method. · Complete the provided steps to verify. In the Receive tab, choose USD Coin as the preferred asset. Click on the Network, and choose Avalanche C-Chain. Coinbase will display a QR code to scan or the. Add and verify your payment method · Sign in to Coinbase and navigate to Payment methods. · Select Add a payment method. · Select your preferred payment method. Sending your tokens to Coinbase: · In the Rainbow app, you can either scan the QR code, or copy and paste the address. · Now in the Rainbow app, click on the. 6. Deposit on OspreyFX using Bitcoin · Select “Deposit” or “Deposit Funds” · Then select “Deposit Type = Bitcoin” · Type the amount you wish to fund · Next, click. You can add cash either from the bank account linked to your Coinbase Inc. spot account or from your USD balance. This can be done either through a web browser. Add a payment method for US customers · Available balance · Using a bank account as a payment method for US customers · Buy crypto · Add cash · Cash out · Gift cards. If you haven't already, please add and verify your payment method on your account. For successful transfers, ensure that the legal name on your Coinbase account. Add a debit card · Sign in to your airfighters.ru account. · Select avatar then choose Settings. · Select the Payment methods tab. · Select Add a payment method. Sign in to Coinbase and navigate to Payment methods. · Select Add a payment method. · Select your preferred payment method. · Complete the provided steps to verify. In the Receive tab, choose USD Coin as the preferred asset. Click on the Network, and choose Avalanche C-Chain. Coinbase will display a QR code to scan or the. Add and verify your payment method · Sign in to Coinbase and navigate to Payment methods. · Select Add a payment method. · Select your preferred payment method. Sending your tokens to Coinbase: · In the Rainbow app, you can either scan the QR code, or copy and paste the address. · Now in the Rainbow app, click on the. 6. Deposit on OspreyFX using Bitcoin · Select “Deposit” or “Deposit Funds” · Then select “Deposit Type = Bitcoin” · Type the amount you wish to fund · Next, click. You can add cash either from the bank account linked to your Coinbase Inc. spot account or from your USD balance. This can be done either through a web browser. Add a payment method for US customers · Available balance · Using a bank account as a payment method for US customers · Buy crypto · Add cash · Cash out · Gift cards. If you haven't already, please add and verify your payment method on your account. For successful transfers, ensure that the legal name on your Coinbase account. Add a debit card · Sign in to your airfighters.ru account. · Select avatar then choose Settings. · Select the Payment methods tab. · Select Add a payment method.

To deposit USDC from an outside source into your International Exchange account, using the drop down, select the Network associated with your deposit address. Select your EUR balance, then Add Cash. The window will display the details that you need to provide your bank for the transfer. Initiate a SEPA transfer from. First, sign in to your Coinbase account and tap Send. Tap the asset you would like to send to your Exodus wallet. Click on the fiat currency you want to fund your account with (in our case that's Euro) and then click on “Deposit” on the screen. text If you want to make a. For US customers, using a bank account is a great way to deposit funds or to purchase assets on Coinbase. Coinbase website · Under the Pay with the field, choose USD Coin as the preferred asset. · Enter the Avalanche C-Chain address to send the funds to. · After. 1. Create an Account on Coinbase · 2. Click “Credit/Debit Card” · 3. Enter your Credit/Debit Card Information · 4. Confirmation · 5. Buy Bitcoin · 6. Deposit on. To add a debit or credit card: Sign in to your airfighters.ru account. Select avatar then choose Settings. Select Payment methods. Select Add a payment method. You can add a bank account by making a deposit using the PayID, or BSB + account number uniquely assigned to your Coinbase account. Using a debit card to buy. Customers in the US can make crypto purchases and/or transfer funds to and from their Coinbase account in three different ways. Unable to buy crypto or add cash · You haven't finished verifying your identity on your account yet, see Verify your identity on Coinbase · Your account might be. 1. Sign in to Coinbase Exchange. 2. Click the Trade tab. 3. Under Wallet Balance, click Deposit. 4. Search for and select the asset you'd. Adding money to your Coinbase wallet is a straightforward process. Here are the steps: Log in to your Coinbase account. Here is how to transfer from Coinbase: Tap the desired cryptocurrency in the Coinbase wallet app. Click "Transfer" then "Send." Select the amount to be. Depositing directly to Polymarket from Coinbase is simple and easy. If you don't have USDC on Coinbase: 1. Click 'Buy & Sell' on the Coinbase homepage. Best for. Buy. Sell. Add cash. Cash out. Speed. Bank Account (ACH). Large and small investments. ✓. ✘. ✓. ✓. business days. Instant Cashouts to bank. Sign in to your airfighters.ru account. · Select Assets in the navigation bar. · Select USD from your assets list. · Select Add cash. · Follow the instructions listed. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. Coinbase currently doesn't accept physical cheques or bill pay as a payment method to purchase crypto or to add cash to a balance. Steps to Address the Issue:Verify Bank Account Details: Ensure that the bank account details you are entering in Coinbase are accurate. This includes checking.

How To Finance An Acquisition

This guide will bring you up to speed on key acquisition finance strategies so that you can plan a strong acquisition strategy with measured risks. The Acquisition Finance department works closely with the departments in charge of market financing (ECM – Equity Capital Markets and DCM - Debt Capital Markets). Acquisition financing is the process of securing capital that is used to fund a merger or an acquisition. An acquisition loan is a loan that businesses use to acquire an asset or even another company. Some (but not all) acquisition loans are used when the asset. Common types of acquisition financing include bank loans, lines of credit, and loans from private lenders. Companies may also turn to loans from the Small. A business acquisition loan provides the funding needed to purchase a portion or all of another business successfully. This guide explains business acquisition. How to finance a business acquisition: Seven financing options · 1. Cash · 2. Earnout / deferred consideration · 3. Shares · 4. Vendor equity · 5. Vendor loan. Debt financing involves borrowing money to finance the acquisition. This could include options such as bank loans, bonds, or other types of debt. How to finance a business acquisition · Establish the value of the acquisition target · Example: Acquisition financing · Equity investment: A proof of. This guide will bring you up to speed on key acquisition finance strategies so that you can plan a strong acquisition strategy with measured risks. The Acquisition Finance department works closely with the departments in charge of market financing (ECM – Equity Capital Markets and DCM - Debt Capital Markets). Acquisition financing is the process of securing capital that is used to fund a merger or an acquisition. An acquisition loan is a loan that businesses use to acquire an asset or even another company. Some (but not all) acquisition loans are used when the asset. Common types of acquisition financing include bank loans, lines of credit, and loans from private lenders. Companies may also turn to loans from the Small. A business acquisition loan provides the funding needed to purchase a portion or all of another business successfully. This guide explains business acquisition. How to finance a business acquisition: Seven financing options · 1. Cash · 2. Earnout / deferred consideration · 3. Shares · 4. Vendor equity · 5. Vendor loan. Debt financing involves borrowing money to finance the acquisition. This could include options such as bank loans, bonds, or other types of debt. How to finance a business acquisition · Establish the value of the acquisition target · Example: Acquisition financing · Equity investment: A proof of.

Cerebro revolutionizes data-driven processes that help companies, entrepreneurs, and sponsors secure financing for M&A transactions. The simplest way to finance the acquisition of a small business is to work closely with the seller and negotiate a “seller note.”. How do you qualify for an acquisition loan? · Credit: A lender will look at your business credit report (if your business has established credit) and run credit. In the early s, leveraged loans and high-yield bonds began to be used to finance leveraged buyouts (LBOs) and other acquisition transactions. The acquiring company can pay the target company through methods such as cash, stock swaps, debt, mezzanine financing, equity, leveraged buyout, or seller's. Acquisition financing provides immediate funding for application to a business transaction, whether through debt, equity, or other hybrid practices. Financing. Business acquisition financing is the capital that is needed for a company to purchase another business. Finance used may be equity, debt or a combination. Acquisition Capital mostly involves a package of different layers of growth capital, including stock purchase / exchange, bank debt, mezzanine funding, and. Business of this size are usually purchased with financing from a combination of sources. The most common are SBA or conventional bank loans, personal savings. Acquisition Financing Formula · Initial LBO Debt = Σ Debt Capital + Interest-Bearing Securities · Total Sources of Funds = Total Debt + Total Equity. US acquisition finance is arranged by US and international banks, who in turn syndicate the financing, and other non-bank lenders. Since the financial. This comprehensive overview will guide you in the process of acquisition financing from start to finish. In this article, you'll find the best financing options for your business acquisition, and how to choose the one that will work for your purposes. When you're seeking %, free-and-clear, no/low-money-down acquisition financing, you are likely best served to find it elsewhere. Accord can provide customized business acquisition loans and financing in a simple and smooth solution to facilitate your plans. Acquisition Capital mostly involves a package of different layers of growth capital, including stock purchase / exchange, bank debt, mezzanine funding, and. Acquisition finance is the capital that is obtained for the purpose of buying another business. The ultimate aim of acquisition financing is to facilitate. WHAT ARE SOURCES OF FINANCE TO BUY A BUSINESS / HOW DO YOU FINANCE A COMPANY ACQUISITION? Government Crown Corporation Bank - talk to our team about the. A guide to our acquisition finance resources. Acquisition finance covers a broad range of financing structures where an existing company or special purpose. Equity financing: With equity financing, businesses issue new shares or sell company stock to raise capital for a merger or acquisition. Companies may also do a.

1 2 3 4 5